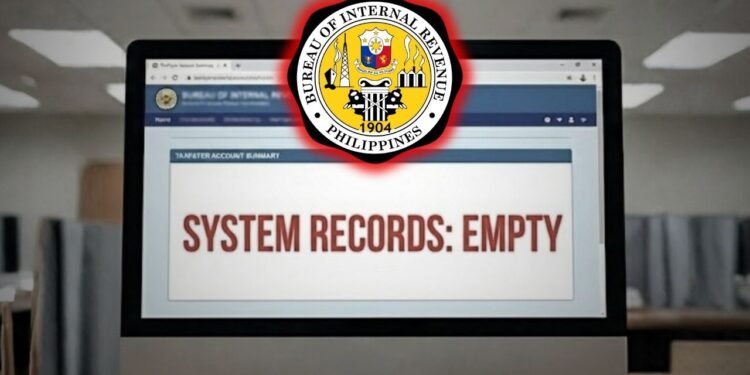

The Bureau of Internal Revenue came under scrutiny after senators found that its taxpayer monitoring system contains no stored data, raising doubts about the agency’s ability to track assessments and payments and prompting calls for an immediate investigation.

The disclosure surfaced during the Senate blue ribbon committee’s probe into alleged corruption involving letters of authority, which allow revenue officers to examine a taxpayer’s books and records. Legislators said the absence of data cripples the BIR’s capacity to validate assessments and verify whether taxes have actually been paid.

“Our report here is that you have no basis to compare the PAN, the FAN, and the 0605 because they are supposedly empty. Kindly investigate, Commissioner,” committee chair and Senate President Pro Tempore Ping Lacson said, addressing BIR Commissioner Charlito Mendoza.

PAN refers to the Preliminary Assessment Notice and FAN refers to the Final Assessment Notice. BIR Form 0605 is used for the payment of taxes and other fees.

“Why is it empty? Was it done on purpose so that we have no records to refer to…?” Lacson asked.

Senator Erwin Tulfo real said he received the same information from a source inside the agency who told him the web-based system is blank. “They saw that it was empty, so no investigating body can check how much was paid to the government, how much was assessed, or how much actually went to the government, because it’s empty. So you really have to investigate that,” Tulfo said.

Commissioner Mendoza initially said the system had not been updated when they first reviewed it after his appointment. Lacson rejected this explanation, saying “The report we received is that it’s empty. It’s not just that it’s not updated.”

Lacson urged the agency to retrieve and restore the missing data. “If you can still reconstruct manually or through some other means, please do that so that we’ll be able to unearth a lot of information,” he said.

Mendoza told the committee that the BIR has begun reconstructing the Iris system, which houses taxpayer assessment and payment records.