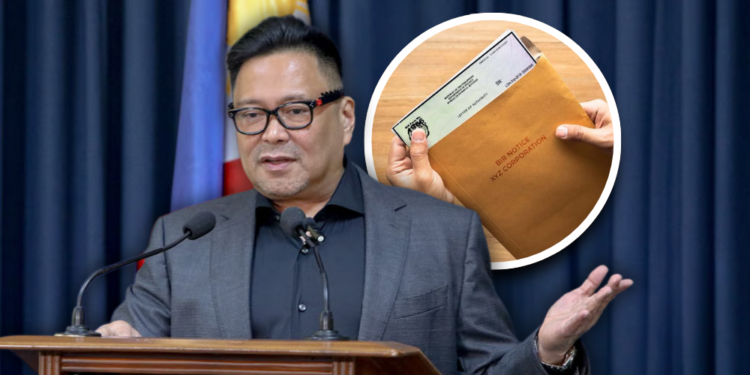

Sen. JV Ejercito is pushing for reforms in the Bureau of Internal Revenue’s handling of Letters of Authority, arguing that fixing the audit process is key to improving government revenue collection. He said the current LOA system has been weighed down by inefficiencies that slow down audits and weaken the BIR’s ability to collect taxes already due to the state. According to Ejercito, the problem is not a lack of taxpayers but a process that often gets stuck in delays.

The senator said reforming the LOA system can directly strengthen revenue performance. “We expect stronger revenue collection with BIR LOA reforms,” Ejercito said, stressing that a simpler and more efficient process would allow the BIR to act faster on audits. He added that streamlining procedures would help remove long-standing bottlenecks that prevent cases from moving forward.

Ejercito said a cleaner LOA system would benefit both the government and taxpayers who already comply with the law. “If the process is clear and transparent, compliant taxpayers are protected, and the government is able to collect what is rightfully owed,” he said. He emphasized that reforms are not about increasing tax rates but about making the existing system work better.

His remarks come amid broader concerns about the government’s fiscal position. Stronger collections, Ejercito said, translate into more funding for public services without placing additional burden on taxpayers. “Every peso properly collected is a peso that can go back to public programs,” he said, pointing out that inefficiencies in audits can result in lost revenue over time.

While the details of LOA reform may be technical, Ejercito framed the goal in simple terms. He said the audit process must become faster, more efficient, and less burdensome. By fixing these weaknesses, he believes the BIR can improve collections with greater speed and transparency, reinforcing his image as a lawmaker focused on practical reforms that strengthen institutions and day-to-day governance.