The Marikina city government has approved a set of measures aimed at easing the financial burden on small businesses and property owners, including a full tax exemption for select enterprises in 2026 and an amnesty program for delinquent real property taxes.

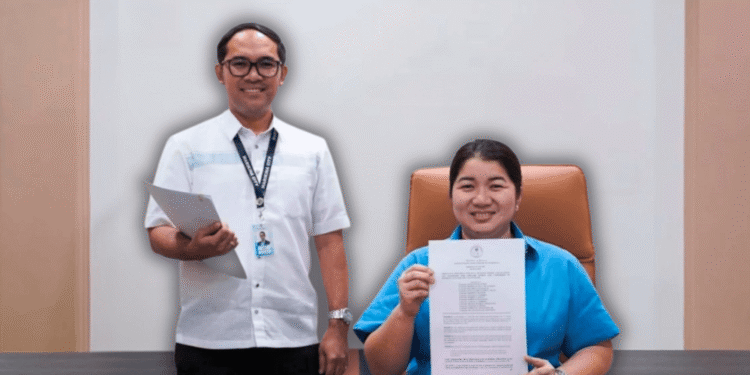

Mayor Marjorie Ann Teodoro approved the ordinances on Monday, citing the city’s intention to support micro, small and medium enterprises and household livelihood activities. The measures provide a 100 percent exemption from local business taxes, permit fees, and regulatory charges for eligible sari-sari stores and eateries from January 1 to December 31, 2026.

Under the ordinance, the tax relief applies only to establishments that do not sell alcohol or cigarettes. Businesses engaged in the sale of liquor and tobacco products are excluded from the exemption. The city’s business permit and licensing office will issue certificates of exemption to qualified store owners.

In addition to the business tax relief, the city government approved a 100 percent amnesty on interests and surcharges for delinquent real property taxpayers. The amnesty program will be in effect until July, allowing taxpayers to settle their obligations either through full payment or staggered installments during the period.

The city also extended the deadline for business permit renewal from January 20 to February 28. No surcharges will be imposed on renewals completed within the extended timeframe.

City officials said the combined measures are intended to provide financial breathing room for small entrepreneurs and residents while encouraging compliance with local tax requirements.