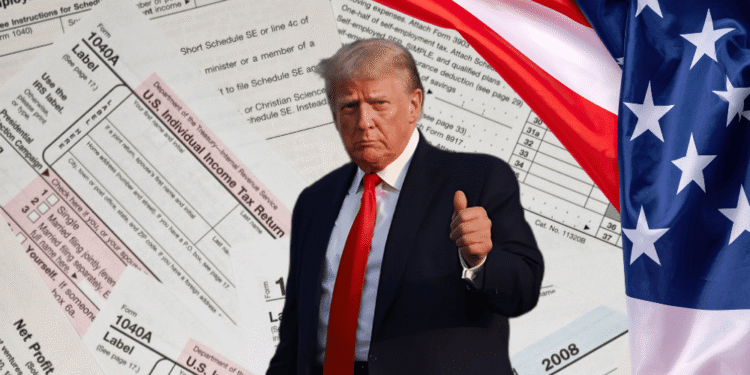

President Donald J. Trump is taking the IRS and the U.S. Department of the Treasury to court with a $10 billion lawsuit, claiming federal agencies failed to stop the leak of his confidential tax information to news outlets between 2018 and 2020. The case was filed Thursday in federal court in Florida and lists Trump’s sons, Eric Trump and Donald Trump Jr., along with The Trump Organization, as plaintiffs.

The filing argues the disclosures caused reputational and financial harm, public embarrassment, and damage to business reputations. It also says the leak portrayed the plaintiffs in a false light and hurt their public standing. Trump’s suit further claims the disclosures adversely affected his support among voters during the 2020 presidential election.

The lawsuit comes after a criminal case tied to the leak. In 2024, former IRS contractor Charles Edward Littlejohn of Washington, D.C., was sentenced to five years in prison after pleading guilty to leaking tax information about Trump and others to news outlets. Littlejohn worked for Booz Allen Hamilton, a defense and national security tech firm, according to the report. Prosecutors said the leaks appeared to be “unparalleled in the IRS’s history.”

The report says Littlejohn, also known as Chaz, provided tax data to The New York Times and ProPublica between 2018 and 2020. The Times reported in 2020 that Trump did not pay federal income tax for many years prior to 2020. ProPublica published a series in 2021 about discrepancies in Trump’s records. The story also notes that six years of Trump’s tax returns were later released by the then-Democratically controlled House Ways and Means Committee.

The disclosure violated IRS Code 6103, described as one of the strictest confidentiality laws in federal statute.

Trump’s lawsuit also follows a U.S. Treasury Department announcement earlier this week that it cut its contracts with Booz Allen Hamilton. Treasury Secretary Scott Bessent said at the time that the firm failed to implement adequate safeguards to protect sensitive data, including confidential taxpayer information accessed through its contracts with the IRS.

Former Justice Secretary and party-list Representative Leila de Lima clarified her stance on proposed legislative changes, emphasizing that she will oppose efforts to extend term limits, remove restrictions...

Read moreDetails